Commercial Transactions Interest Rate

The concept of cash laundering is essential to be understood for those working within the financial sector. It's a course of by which dirty cash is transformed into clean money. The sources of the money in precise are prison and the money is invested in a approach that makes it look like clear money and conceal the identity of the legal a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new prospects or maintaining existing prospects the duty of adopting sufficient measures lie on each one who is a part of the group. The identification of such component in the beginning is simple to deal with instead realizing and encountering such situations in a while within the transaction stage. The central financial institution in any country gives complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

800 Belgian Official Journal of - First half of the year 2016. The 3 interest rate can be changed to a lower or higher rate by a Royal Decree which may be issued from time to time in response to the prevailing economic conditions.

Statutory interest rate for late payment is 8 percentage points above the European Central Banks reference rate.

Commercial transactions interest rate. The ECB rate in force on 1 January and 1 July apply for the following six months in each year. 225 Belgian Official Journal of January 18th 2016 -Second half of the year 2016. How to Determine Interest Rate for Late Payment Obligations in Commercial Transaction.

Search for results at TravelSearchExpert. This rate equates to a daily rate of 0022. Ad Search for results at MySearchExperts.

The Malta Association of Credit Management MACM informs the Maltese business community that the applicable legal interest rate in the event of late payment in commercial transactions in force on 1 st July 2020 is 800. Commercial transaction in law the core of the legal rules governing business dealings. Enterprises are automatically entitled without the necessity of a reminder to interest for late payments.

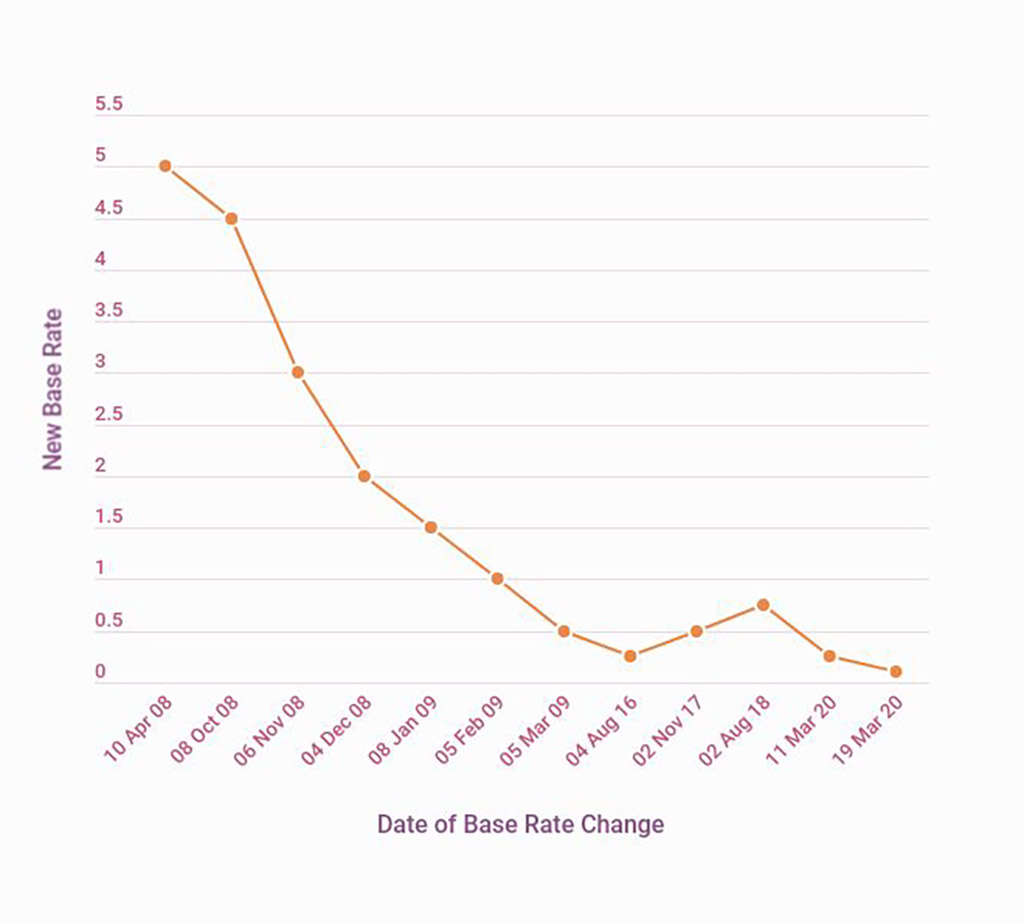

Find info on MySearchExperts. Interest on late commercial payments The interest you can charge if another business is late paying for goods or a service is statutory interest - this is 8 plus the Bank of England base rate. The most common types of commercial transactions involving such specialized areas of the law and legal instruments as sale of goods and documents of title are discussed below.

Where late payment interest falls due the supplier is also entitled to the automatic payment of compensation costs. As from the 13th of August 2012 the Directive 20117EU of the European Parliament and of the Council of 16th February 2011 on. In the same period the interest rate for commercial transactions reached a value of approximately eight percent.

The interest rate of 2436 percent considerably beyond normal rates. Statutory interest is 8 plus the Bank of England base rate for business to business transactions. Where a contract-breaching party delays making payment for goods or payment of service charges and other reasonable fees the aggrieved party may claim an interest on such delayed payment.

Ad Find your search here. With effect from 1 July 2021 the late payment interest rate is 800 per annum that is based on the ECB rate as at 1 July 2021 of 000 plus the margin of 8. Penalty interest due for late payments should be calculated at a daily rate.

Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows. For the year 2017 it has been set at 20. If there is no such agreement or if the commercial transaction is between an undertaking and a public authority the applicable interest rate is equal.

Generally the Ministry of Finance shall review the interest rate every period of 3 years taking into account the interest rates of deposits and loans of commercial banks. Updated on 31072020 at 1132. Find info on MySearchExperts.

Search for results at TravelSearchExpert. For example if the Bank of England base rate is 05 statutory interest for a recent debt would. Ad Find your search here.

How to Determine Interest Rate for Late Payment Obligations in Commercial Transaction. Description The interest rate for late payment of obligations in commercial business is applied according to the average interest rate on overdue debts in the market at the time of payment corresponding to the late payment period unless otherwise agreed or otherwise provided by law. You cant claim statutory interest if your customer is a consumer and not acting in the course of a business in this case you can only claim interest if the contract sets a contractual rate.

The legal interest rate for late payments in commercial transactions will be 8 as of January 1 2018 since the applicable ECB rate that would be added to this baseline rate is currently zero. 850 Belgian Official Journal of February 1st 2016 LEGAL BASIS. SHEET LEGAL INTEREST RATES LEGAL INTEREST RATE LEGAL INTEREST RATE FOR COMMERCIAL TRANSACTIONS AMOUNT For 2016.

Ad Search for results at MySearchExperts. Interest rate applicable to commercial transactions In the same way as for civil and commercial matters the legal interest rate applicable in the event of late payment in commercial transactions applies only if the two parties have not agreed on another interest rate in the contract binding them.

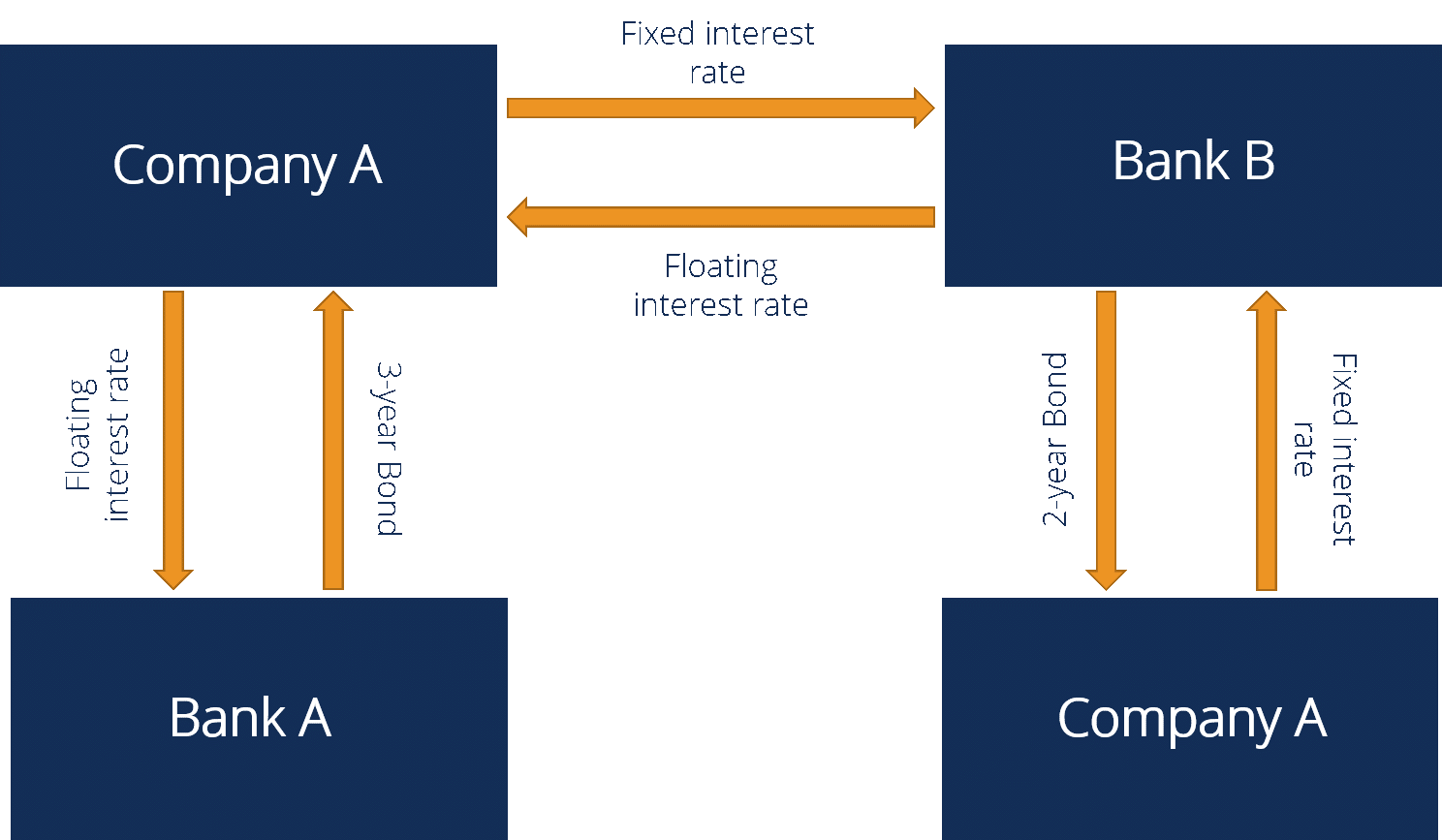

Floating Interest Rate What You Need To Know About Variable Rates

Interest Rate Swap Learn How Interest Rate Swaps Work

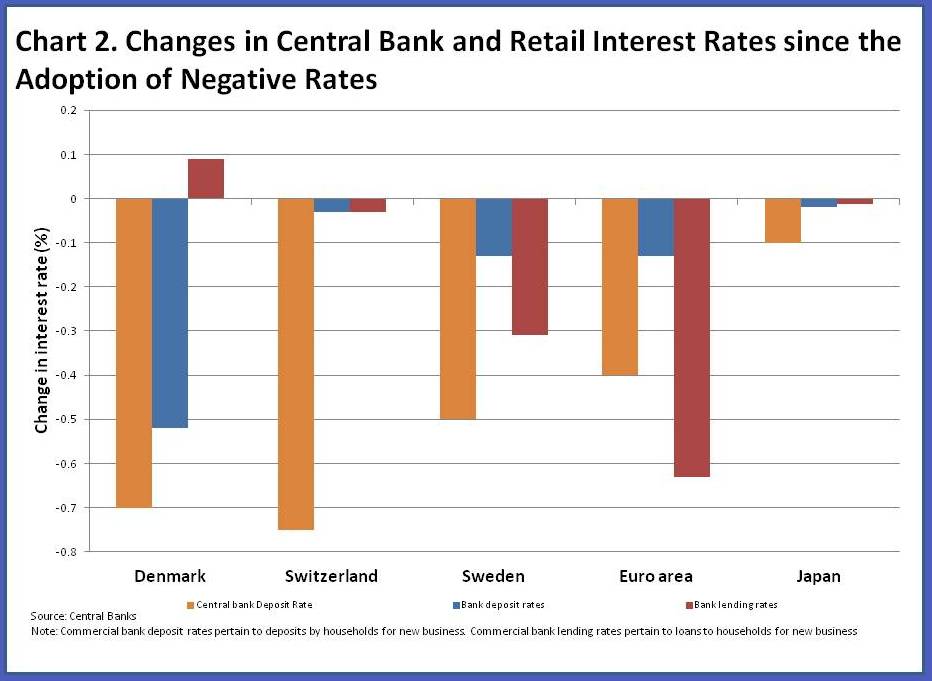

The Broader View The Positive Effects Of Negative Nominal Interest Rates Imf Blog

Reserve Bank Of India Database

Bank Of England Base Rate Money Co Uk

Reserve Bank Of India Database

/GettyImages-140671550-56a636e83df78cf7728bdbc1.jpg)

Interest Rate Definition Formula Calculation

Interest Rates A Key Concept In Economics

Discount Rate Vs Interest Rate 7 Best Difference With Infographics

Discount Rate Vs Interest Rate 7 Best Difference With Infographics

Reserve Bank Of India Database

History Of Interest Rates In Australia Infochoice

How The Reserve Bank Implements Monetary Policy Explainer Education Rba

The world of regulations can seem like a bowl of alphabet soup at occasions. US cash laundering regulations are not any exception. We have compiled an inventory of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting firm centered on defending monetary companies by decreasing danger, fraud and losses. We have huge financial institution experience in operational and regulatory danger. We now have a strong background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many antagonistic penalties to the group due to the risks it presents. It will increase the chance of major dangers and the opportunity value of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment