Money Laundering Methods In India

The idea of cash laundering is very important to be understood for these working in the monetary sector. It's a course of by which dirty money is converted into clear cash. The sources of the money in actual are felony and the money is invested in a method that makes it look like clean money and conceal the id of the criminal a part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the brand new customers or sustaining existing prospects the duty of adopting sufficient measures lie on each one who is part of the organization. The identification of such factor at first is simple to deal with as an alternative realizing and encountering such conditions later on within the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such situations.

According to AML laws in India people committing money laundering offenses are sentenced to up to 10 years in prison. The major purpose is to change the form of the proceeds from conspicuous bulk cash to some equally valuable but less conspicuous form.

Administrative and fines are imposed on financial institutions that do not comply with AML compliance.

Money laundering methods in india. Money Laundering Penalties in India. Techniques of Money Laundering in India There are several ways to launder money. A look at the key elements of criminal money laundering offences in India including qualifying assets and transactions predicate offences defences and sanctions.

The money laundering crime in India has huge penalties. MONEY LAUNDERING IN INDIA1-Paridhi Saxena NLU Raipur The aim of this paper is to study and evaluate the concept of money laundering in India and its law enforcement. In India money laundering is widely known as the Hawala trade.

In India money laundering is popularly known as Hawala transactions. Hawala is an alternative or. Anti-Money Laundering Solutions for India.

Money laundering is called what it is because that perfectly describes what takes place illegal or dirty money is put through a cycle of transactions or washed so that it comes out the other end as legal or clean money. Other methods of Money Laundering include. Sanction Scanner is an AI-driven Anti-Money Laundering.

The most popular technique is the establishment of the fake companies also known as the shell companies. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders.

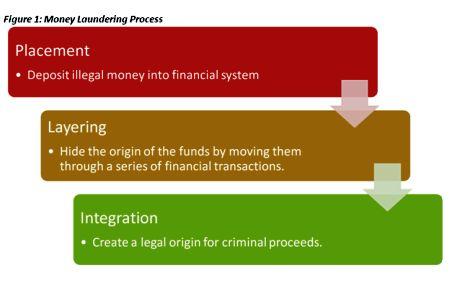

Hawala is a different or similar payment system. Asset Purchase The purchase of assets with cash is a classic money laundering method. Money Laundering is commonly referred to as the concept of concealing relocating or seeking to retain the profits conducted from a crimeLaundered money is introduced into the financial system of the economy by the launderer following three step mechanism ie.

Placement layering and integration. It gained popularity during early 1990s when many of the politicians were caught in its net. Legal resource on Indian anti money laundering laws in India prevention of money laundering act pmla aml anti money laundering offences punishment under pmla legal advice on aml.

Most of these Shell Companies are regular in complying with Government of India. Bulk Cash Smuggling. Hawala is an Arabic word meaning to transfer money or information between two people through a.

Buying a large house shop or mall but showing less value on paper while the actual market value of these purchased properties is much higher. It gained popularity during the early 1990s when many politicians were caught in their net. In other words the source of illegally obtained funds is obscured through a succession.

Money laundering happens in almost every country in the world and a single scheme typically involves transferring money through several countries in order to obscure its origins. This is when a huge amount of money is physically smuggled in cash to faraway places such as off-shore banks that do not have money laundering checks in place or cater to clients in an especially secretive manner. Four methods of money launderingcash smuggling casinos and other gambling venues insurance.

A well renowned system developed in India has been that of Hawalawhich runs parallel to the traditional banking methods to launder money. Financial institutions in India have to meet AML obligations.

Guide To Money Laundering In The Year 2021 Regtechtimes

Anti Money Laundering Fuzzy Logix

Money Laundering Define Motive Methods Danger Magnitude Control

Money Laundering Process Download Scientific Diagram

How Money Laundering Works Money Laundering How To Get Money Finance Investing

Money Laundering Video Presentation Youtube

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Business Advice

Risks Free Full Text Efficiency Of Money Laundering Countermeasures Case Studies From European Union Member States Html

How Money Is Laundered In India Rediff Com Business

Money Laundering Money Laundering Financial Action Task Force On Money Laundering

Https Www Igi Global Com Viewtitle Aspx Titleid 274814

What Is Money Laundering And How Is It Done

What Is Money Laundering Three Methods Or Stages In Money Laundering

The world of regulations can seem like a bowl of alphabet soup at occasions. US cash laundering regulations aren't any exception. Now we have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting agency centered on defending monetary providers by lowering risk, fraud and losses. We've got huge financial institution experience in operational and regulatory danger. We have a strong background in program administration, regulatory and operational danger as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many adversarial consequences to the organization as a result of dangers it presents. It increases the chance of main dangers and the chance price of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment