Money Laundering Regulations 2017 Scotland

The idea of money laundering is essential to be understood for these working within the financial sector. It's a process by which soiled cash is transformed into clear cash. The sources of the cash in precise are felony and the cash is invested in a means that makes it appear like clear money and hide the identification of the legal part of the money earned.

Whereas executing the financial transactions and establishing relationship with the new clients or sustaining existing clients the responsibility of adopting satisfactory measures lie on every one who is a part of the group. The identification of such factor to start with is simple to cope with instead realizing and encountering such conditions later on within the transaction stage. The central bank in any country provides complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such situations.

The office is a new regulatory body with the general oversight pf the supervisory anti-money laundering regime and the OPBAS has duties and powers to ensure the professional body anti-money laundering supervisors meet the standards required by the Money Laundering Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 have been amended by statutory instrument to take account of changes imposed by the EUs 5th Money Laundering Directive with effect from 10 January 2020.

Https Londonscottishhouse Org Wp Content Uploads 2020 06 Aml Web V2 0 Pdf

Revision to Rule B9 brings into effect the tenets of The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Money laundering regulations 2017 scotland. 2 These Regulations come into force on 26th. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. As defined in regulation 31 of the Money Laundering Regulations reporting period the 12 month period running from 1 January to 31 December or such other period as the Council may prescribe supervised person a relevant person for which the Society is the supervisory authority in terms of the Money Laundering Regulations. The 2017 MLRs have been informed by the responses submitted and reflect the.

When in July 2017 new legislation came into force meaning SLPs would have to specify the persons behind their companies known as The Scottish Partnerships Register of People with Significant Control Regulations 2017 we all for a very short while became hopeful. Rule B6 Duty of Co Operation Rule B6 is formed of a clear obligation upon Society Members to co-operate with the Society in a open timely and co-operative manner. They also confirm firms may outsource CDD but.

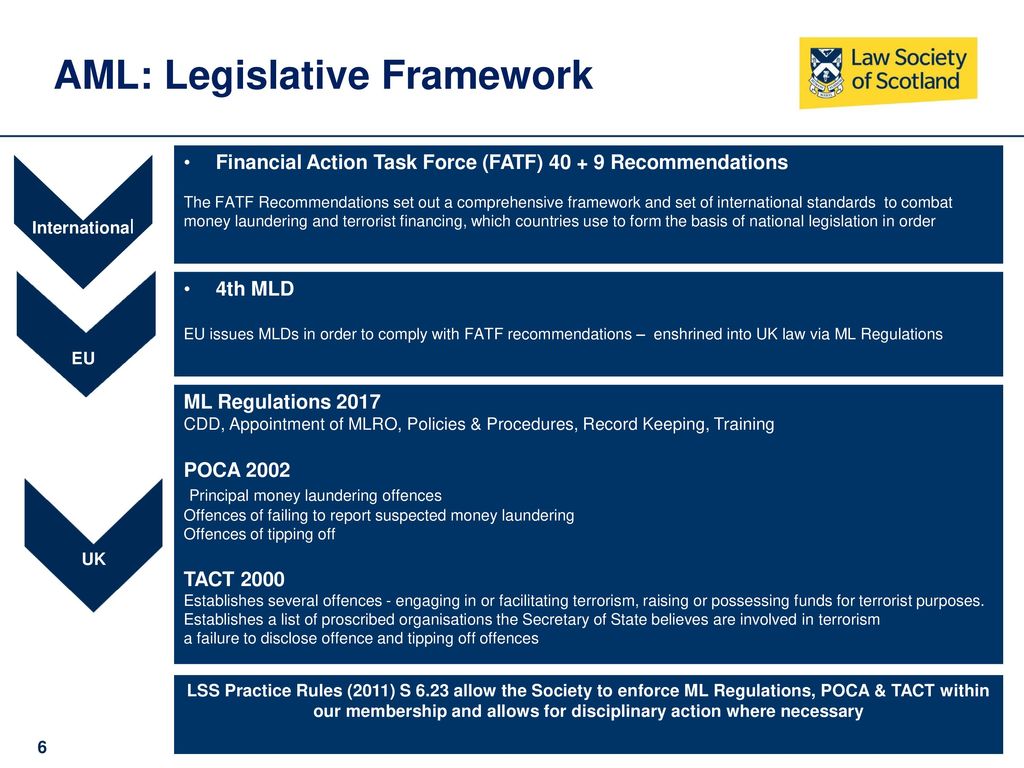

20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the use of the financial system for the purpose of money laundering. These Regulations replace the Money Laundering Regulations 2007 SI. The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017.

123 Regulation 11d of the 2017 Regulations defines tax adviser to include both direct and indirect provision of material. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week.

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The Regulations make significant changes to the AMLCTF regime in the UK and below is an outline of some of these. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 S. 692 b the following shall be added after the definition of regulated person. To any financial crime professional SLPs are clearly a major concern.

Confirm with their anti-money laundering supervisory authority whether their activities require supervision under the 2017 Regulations. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person. 5 July 2017 New Money Laundering Regulations 2017 On 26 June 2017 the new Money Laundering Regulations 2017 came into force the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Aml Roadshow 2017 The New Ml Regulations What

Aml Roadshow 2017 The New Ml Regulations What

Anti Money Laundering Ppt Download

The Money Laundering Terrorist Financing And Transfer Of Funds Information On The Payer Regulations 2017 Impact Assessment

Aml Roadshow 2017 The New Ml Regulations What

Anti Money Laundering Ppt Download

New Aml Guidance What You Need To Know Law Society Of Scotland

Fillable Online Anti Money Laundering Statement Fax Email Print Pdffiller

Anti Money Laundering Ppt Download

Aml Roadshow 2017 The New Ml Regulations What

The Money Laundering Terrorist Financing And Transfer Of Funds Information On The Payer Regulations 2017 Explanatory Memorandum

Http Www Cimaglobal Com Documents Members 20handbook New 20money 20laundering 20regulations 202017 Pdf

Aml Roadshow 2017 The New Ml Regulations What

The Oversight Of Professional Body Anti Money Laundering And Counter Terrorist Financing Supervision Regulations 2017 Explanatory Memorandum

The world of laws can seem like a bowl of alphabet soup at times. US cash laundering regulations are no exception. We've compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on protecting financial companies by reducing danger, fraud and losses. Now we have big bank experience in operational and regulatory threat. We've got a robust background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many hostile penalties to the organization because of the risks it presents. It will increase the probability of major dangers and the chance price of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment